Diving into the realm of proprietary trading is an exciting yet challenging endeavor. Securing a funded trading account via a prop firm evaluation is crucial. This guide will equip you with the insights and strategies needed to excel in a prop firm evaluation. It’s your essential first step toward becoming a funded trader.

Key Insights

- Recognize the significance of prop firm evaluations and how they can propel your trading career.

- Explore the various types of prop firm challenges and the criteria needed to succeed in each.

- Master effective risk management strategies and position sizing techniques to navigate the evaluation process.

- Identify and steer clear of common trading pitfalls that could impede your success during the evaluation.

- Discover the advantages of selecting a prop firm that aligns with your trading style and objectives.

Understanding the Significance of Prop Firm Evaluations

In the trading landscape, proprietary trading firms, commonly known as “prop firms,” are increasingly popular. These firms allow traders to utilize substantial capital and receive professional support, minimizing their financial risk.

What is a Proprietary Trading Firm?

A proprietary trading firm employs its capital to engage in trading activities, including stocks and currencies. They boast a team of experienced traders who leverage various strategies and tools to identify and capitalize on market opportunities.

Types of Prop Firm Evaluations

- Live Account Evaluation: Traders receive a funded account to trade using the firm’s capital, demonstrating their ability to generate consistent profits.

- Simulated Account Evaluation: Traders operate on a simulated platform, allowing the firm to assess their skills and decision-making without exposing real capital to risk.

Why Traders Opt for Prop Firms

Traders are drawn to prop firms for several reasons, including:

- Access to Significant Trading Capital: Prop firms provide traders with more capital than they could access independently, increasing their earning potential.

- Professional Resources and Mentorship: These firms offer training, coaching, and mentorship, helping traders enhance their skills and develop successful strategies.

- Risk Mitigation: Trading with the firm’s capital protects traders from risking their funds, making it an attractive option for newcomers.

Understanding proprietary trading firms and their evaluations is crucial for traders seeking to enter the professional trading arena. Prop firms offer numerous advantages.

Comprehensive Guide to Successfully Navigating a Prop Firm Evaluation

Completing the evaluation process at a prop firm is a significant milestone for traders. Having a well-thought-out strategy is essential for overcoming this trading challenge. This guide will equip you with the tools and strategies needed to excel in your prop firm evaluation.

- Thorough Preparation: Begin by thoroughly familiarizing yourself with the prop firm’s rules and expectations. Understanding their trading guidelines, risk management protocols, and performance metrics will enable you to showcase your skills effectively.

- Create a Tailored Trading Plan: Develop a comprehensive trading plan that aligns with the firm’s requirements. Incorporate risk management strategies, position sizing, and clear entry and exit rules to demonstrate your disciplined approach to trading.

- Practice in a Simulated Environment: Test your strategies in a simulated setting. This practice will help you refine your techniques and identify areas for improvement. Maintain a record of your trades and analyze them to enhance your strategy further.

- Prepare Your Trading Setup: Ensure that your trading setup is fully prepared for the evaluation. Conduct thorough tests to prevent any technical issues during the live trading challenge.

- Stay Committed to Your Plan: During the evaluation, remain focused on your trading plan and adhere to your risk management strategies. Comply with the firm’s rules to demonstrate your trading capabilities. Keep a level head and make informed decisions based on your established strategies.

After the evaluation, take the time to thoroughly review your performance. Analyze what strategies were effective and which ones fell short. Implement adjustments to enhance your skills. Continuously seek opportunities to learn and reflect on your trading practices to ensure long-term success.

Preparing for Your Prop Firm Evaluation

By following this guide, you’ll be well-equipped for the prop firm evaluation, increasing your chances of landing a fantastic trading opportunity. Embrace the challenge, maintain discipline, and showcase your trading abilities.

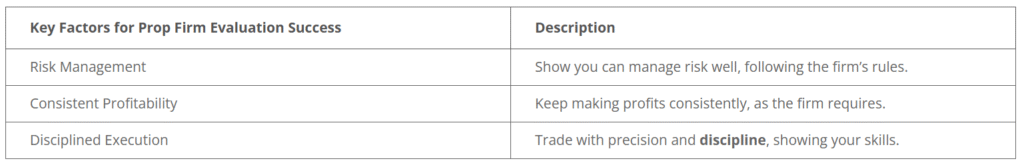

Common Rules and Requirements for Prop Firm Challenges

Aspiring traders encounter a rigorous assessment to join a proprietary trading firm, known as a “prop firm challenge.” This evaluation assesses their risk management skills, profit objectives, and adherence to trading rules. Understanding the requirements set by prop firms is essential for successfully passing these assessments and securing a position.

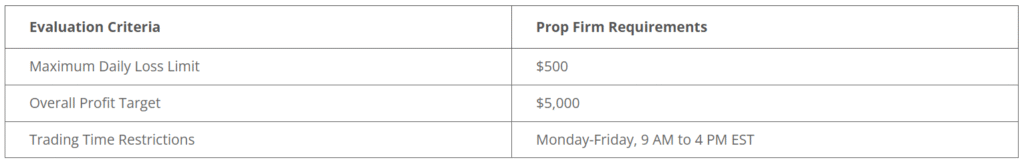

Maximum Daily Loss Limits

Prop firms impose strict limits on the maximum daily loss a trader can incur. This rule is designed to safeguard the firm’s capital and control the trader’s risk-taking behavior.

Overall Profit Targets

Additionally, prop firms establish profit targets that traders must achieve. These goals help the firm evaluate whether a trader can generate consistent profits and determine if they align with the firm’s objectives.

Trading Time Restrictions

Another important regulation pertains to trading hours. These time restrictions dictate when trades can be executed, ensuring a fair testing environment and that the trader meets the firm’s standards.

Adhering to these rules can significantly enhance a trader’s likelihood of successfully passing a prop firm challenge, ultimately paving the way for a position within a proprietary trading firm.

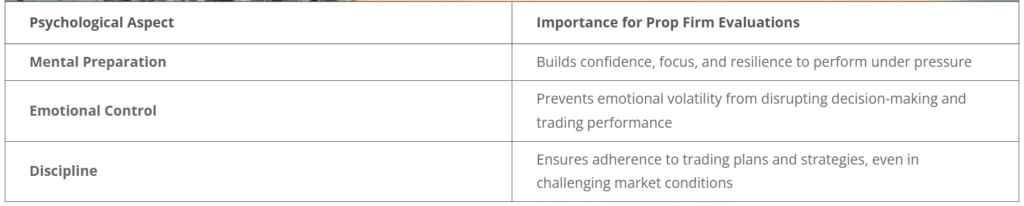

Key Trading Psychology for Success in Evaluations

Excelling in prop firm evaluations involves more than just trading skills; mental preparedness, emotional regulation, and a disciplined approach are essential. These qualities are crucial for performing effectively under pressure. By prioritizing the psychological aspects of trading, you can enhance your chances of passing these challenging assessments.

Developing a Winning Mindset

Fostering a positive and resilient trading mindset is crucial for tackling prop firm evaluation challenges. This entails:

- Viewing setbacks as opportunities for growth and improvement.

- Utilizing mental techniques like visualization and affirmations to maintain confidence and focus.

- Committing to continuous learning and skill enhancement.

Mastering Emotional Control

Emotional challenges can significantly impact traders during evaluations. Strong emotional control is necessary for consistency:

- Employ stress management techniques such as deep breathing and meditation to maintain composure.

- Learn to manage your emotions quickly to prevent them from influencing your decisions.

- Stay disciplined and adhere to your trading plan, even in difficult situations.

“Successful trading is 20% strategy and 80% mindset.” – Market Guru

By cultivating a strong trading mindset, mastering emotional regulation, and maintaining discipline, you can achieve success in prop firm evaluations and beyond.

Crafting an Effective Trading Strategy for Evaluations

Developing a successful trading strategy is essential for prop firm evaluations. It involves striking the right balance between risk management, position sizing, and well-defined entry and exit rules. Mastering these components can significantly enhance a trader’s performance in the evaluation process.

Risk Management Techniques

Robust risk management forms the foundation of a profitable trading plan. Prop firms closely examine how effectively traders manage risk. It’s crucial to implement strong techniques such as:

- Setting appropriate stop-loss levels to limit losses.

- Diversifying to mitigate risk exposure.

- Maintaining a consistent risk-reward ratio for favorable trades.

Position Sizing Methods

Effective position sizing is vital for managing risk and maximizing returns during prop firm evaluations. Traders should explore various methods, including:

- Fixed Fraction Sizing: Allocating a predetermined percentage of account capital for each trade.

- Risk-Based Sizing: Adjusting trade size based on the specific risk involved.

- Volatility-Based Sizing: Modifying trade size in response to market volatility.

Entry and Exit Rules

Establishing clear entry and exit rules is crucial for consistent trading. Prop firms assess how well traders identify promising trade setups and manage them. Consider implementing:

- Specific technical and fundamental criteria for entering trades.

- Defined profit targets and stop-loss levels for effective trade management.

- Strategies for handling and minimizing potential losses.

Incorporating these essential elements into your trading plan will enable you to create a comprehensive and optimized strategy, thereby increasing your chances of successfully passing the prop firm evaluation.

Common Trading Mistakes to Avoid During Evaluations

Navigating a proprietary trading firm (prop firm) evaluation can be challenging. Even seasoned traders can stumble into pitfalls that hinder their performance. Recognizing these common mistakes is crucial for achieving success. Here are the top errors to avoid during your prop firm evaluation.

1. Overtrading

Many traders find themselves overtrading during evaluations. The pressure to succeed can lead to hasty decisions, resulting in excessive trades and increased risk. It’s essential to prioritize quality trades over quantity.

2. Emotional Trading

The stress of evaluations can trigger emotional decision-making, which can negatively impact your results. Managing emotions like fear and greed is vital. Staying composed and thinking rationally is key to achieving success.

3. Risk Management Failures

Poor risk management can lead to significant losses. Traders must implement a solid risk management plan, including knowing when to stop trading and diversifying their portfolio. Neglecting these fundamentals can result in major setbacks.

4. Other Common Errors

Traders should also be vigilant about other mistakes, such as poor trade execution and insufficient market analysis. These oversights can accumulate and jeopardize your chances of success.

By steering clear of these common pitfalls, traders can enhance their likelihood of passing the evaluation and securing a position at a top proprietary trading firm.

“Successful trading is about managing risk, not maximizing returns.” – Anonymous

Best Practices for Money Management in Prop Trading

Effective money management is essential for success in prop trading. It involves safeguarding capital, controlling risks, and managing drawdowns, all of which are vital for passing evaluations and fostering a long-term trading career.

Calculating Position Sizes

Determining the appropriate position size is crucial for effective risk management. Traders should adopt position sizing methods that align with their strategy and risk tolerance, whether that means using a fixed percentage of capital or adjusting sizes according to market conditions.

Managing Drawdowns

Drawdowns are an inherent aspect of trading. Having a robust plan for managing drawdowns is critical. This includes setting loss limits, diversifying strategies, and employing effective risk controls to minimize the impact of drawdowns.

Setting Stop Losses

Protecting your capital is paramount, and stop losses play a vital role in this. Traders must assess market conditions and associated risks to establish appropriate stop-loss levels. Consistent use of stop losses helps safeguard capital and supports preservation during evaluations.

By adhering to these best practices for money management, prop traders can approach evaluation challenges with confidence, thereby increasing their chances of success and building a solid trading career.

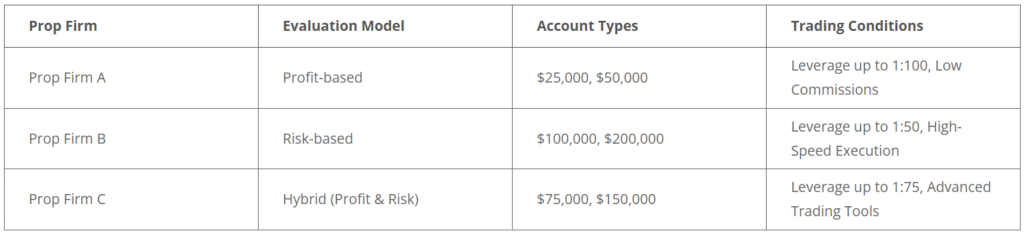

Choosing the Right Prop Firm for Your Trading Style

Selecting the appropriate prop firm is crucial for your trading success. With various prop firm comparison models, account types, and trading conditions available, understanding your trading style and objectives is essential to find the best match.

Evaluation Model

Examine the evaluation model of the prop firm. Some firms prioritize profit, while others emphasize risk management and consistency. Ensure that their rules align with your trading approach.

Account Sizes

Prop firms offer a range of account sizes, from small to large. Consider your risk tolerance and financial goals when selecting the right account size for you.

Trading Conditions

Evaluate the trading conditions provided by the prop firm. Key factors include leverage, order execution quality, and available trading tools. Ensure that the firm’s setup aligns with your trading style and supports your path to success.

By thoughtfully considering these factors and aligning them with your trading style and objectives, you can select the right prop firm. This choice will provide you with optimal trading conditions and evaluation models, setting you up for success.

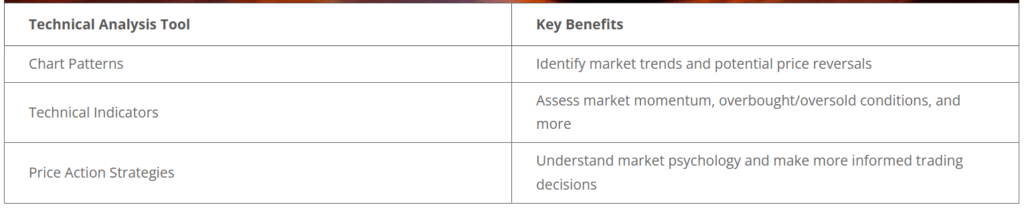

Technical Analysis Tools for Evaluation Trading

Technical analysis tools play a vital role in prop firm evaluations. They enable traders to gain an advantage by identifying key chart patterns and utilizing important trading indicators. Mastering these tools can significantly impact your chances of passing the evaluation challenge.

Essential Chart Patterns

Recognizing chart patterns is crucial for traders looking to excel in prop firm evaluations. Familiarize yourself with patterns such as head and shoulders, double tops and bottoms, and triangles. Understanding these patterns can help forecast market movements and inform smart trading decisions.

Key Technical Indicators

Technical indicators offer valuable insights for trading during evaluations. Tools like moving averages, the Relative Strength Index (RSI), and the Stochastic Oscillator provide information on trends, momentum, and potential overbought or oversold conditions. Effectively using these indicators can enhance your trade timing.

Price Action Strategies

Studying price action is an effective method for grasping market behavior beyond just indicators. By analyzing candlestick patterns, support and resistance levels, and other price signals, you can develop a deeper understanding of market dynamics. This insight aids in making informed trading decisions during evaluations.

Becoming proficient in these technical analysis tools and techniques can greatly benefit your performance in prop firm evaluations. By learning to identify chart patterns, utilize indicators, and comprehend price action, you can enhance your trading decisions and improve your chances of success in the evaluation.

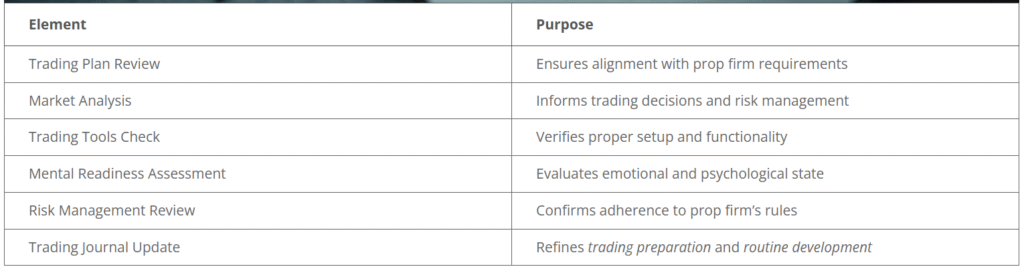

Creating a Pre-Trading Checklist for Evaluations

Successfully passing a prop firm evaluation requires diligent preparation and a consistent routine. A comprehensive pre-trading checklist can significantly enhance your performance, helping you maintain consistency and improve your trading skills throughout the evaluation.

Here are essential items to include in your pre-trading checklist for prop firm evaluations:

Review Your Trading Plan and Strategy

Ensure that your trading plan aligns with the prop firm’s rules and risk parameters. This alignment is crucial for success.

Check Your Market Analysis

Stay updated on the latest market trends, economic news, and any events that may impact your trades. This information is vital for informed decision-making.

Verify Your Trading Tools and Platform

Confirm that your trading tools and platform are properly set up and functioning smoothly. Technical issues can disrupt your trading performance.

Assess Your Mental State

Take a moment to evaluate your emotional readiness for trading. Are you focused, calm, and prepared to make decisions?

Review Your Position Sizing and Risk Management

Double-check that your risk management strategies and position sizing are in accordance with your plan and the prop firm’s guidelines.

Prepare Your Trading Journal

Review your past trading journal entries and make necessary updates. This practice aids in refining your trading preparation and developing a consistent routine.

By establishing and adhering to a pre-trading checklist, you can optimize your trading performance and demonstrate your consistency to the prop firm, thereby increasing your chances of passing the evaluation.

“Consistency is the key to success in prop firm evaluations. A well-developed pre-trading checklist can help you maintain that consistency throughout the challenge.”

Real-Time Market Analysis During Evaluations

Navigating the fast-paced financial markets during a prop firm evaluation can be challenging. However, mastering real-time market analysis can provide a significant advantage. By monitoring market sentiment, staying updated with news, and analyzing trading volume, you can make informed decisions that can determine your success.

Assessing Market Sentiment

Understanding market sentiment is essential for predicting price fluctuations and adapting your strategy accordingly. Look for indicators of investor fear or greed, and keep an eye on the VIX (Volatility Index) to gauge overall market sentiment. This insight can help you identify market shifts and capitalize on emerging trends.

Leveraging News Impact Trading

In the dynamic environment of prop firm evaluations, news events can have a profound impact on prices. Learn to identify news that drives market movements and be prepared to trade on it. Monitor economic reports, global events, and industry-specific news to stay ahead of the competition.

Analyzing Trading Volume

Trading volume reflects market activity and can provide clues about potential price trends. Pay attention to changes in volume, as they may indicate shifts in market sentiment and possible price movements. Incorporating volume analysis into your trading strategy can enhance your decision-making during evaluations.

By effectively utilizing these real-time market analysis techniques, you can improve your trading performance and increase your chances of success in prop firm evaluations.

Using these real-time market analysis methods in your prop firm evaluation strategy can significantly enhance your chances of success. They demonstrate your trading skills to the evaluators. Remember, staying attuned to market sentiment, relevant news, and trading volume is essential for navigating evaluation challenges.

Conclusion

Successfully passing a prop firm evaluation requires a strategic approach, strict discipline, and a solid understanding of trading. You’ve learned the key principles, effective strategies, and mental management techniques needed for evaluation success, positioning you to become a funded trader.

This guide has equipped you with the tools to tackle the challenges of prop firm evaluations. Now is the time to apply what you’ve learned to advance your trading career. Maintain consistency, manage risks effectively, and stay committed to your craft—this is the foundation for success in prop trading.

Embrace the lessons learned, refine your trading plan, and confront the prop firm evaluation challenges with confidence. With dedication and a pursuit of excellence, you’ll reach your trading career goals.